Welcome to EZ2 Reverse, our success assurance program

Are you new to the reverse mortgage space and finding yourself wondering how to get started? Well, you’ve come to the right place! Our Broker program is built on the idea that there is enough opportunity in the world for everyone to succeed with a little training and support from our experienced reverse mortgage professionals. That’s why we designed the EZ2 Reverse success assurance program to guide you from customer acqusition to closing and everything in between.

To assist you through the learning phase we are offering to provide a success partner during each phase of the process to help you build your knowledge and confidence.

If you’re ready to get started

Let’s Go Reverse!

We provide your pathway to success!

Imagine having a seasoned Money House reverse specialist by your side through each step of the process, coaching you, guiding you until you build the confidence you need to fully incorporate the reverse mortgage into your lending portfolio. Use our signup form to let us know you are interested in our EZ2 Reverse full support program.

Along the way you’ll get support for:

Calculating Loan Proceeds – How Much do They Qualify for?

You’ve gotten your first lead, congratulations! If you’re new to the Reverse Mortgage space you may find yourself in unfamiliar territory, but that’s ok because we here at Money House Reverse are here to ensure you succeed.

So, let’s Go Reverse!

Of course, the first thing you will want to do is get 4 pieces of information to calculate the proceeds available to the borrower:

- State where the subject property is

- Age of the youngest borrower

- Value of the subject property

- Any outstanding balances on existing mortgage or liens

Once you have that information, access our free calculator to run the numbers. These estimates are a great indicator for determining if the loan amount available meets the borrowers expectations and the viability of the loan.

Access Our Calculator

Generating the Proposal in Quantum Reverse LOS

Collect the Borrower’s Details

In order to generate a loan proposal in Quantum you will need to collect some information to determine what the borrower qualifies for and to familiarize yourself with the deal you are preparing for. We’ll need you to either complete our Scenario Request Form or login to Quantum and generate the proposal yourself – We’ll show you how to do this yourself as well.

We’ll email and/or call you with the results and discuss the additional details you may need, to get in order to be fully prepared ready, for the next step of contacting the borrower to discuss the details. The available equity will determine what options are available to you.

We are committed to coaching you through the whole process until you gain the confidence to thrive in the reverse mortgage space.

Scenario Request Form

Discussing loan details with the borrowers & answering their questions

You can count on your success partner at Money House to help you through calls with your client.

Ok, so you have a proposal ready to present, but you don’t feel prepared to confidently explain all the details to them.

This is not an uncommon concern and may be the single biggest barrier to comfort in this space. That’s why we provide the support you need to overcome this hurdle.

You let us know when you want to schedule your call with the borrower and we’ll do a 3 way call where we can fill in any blanks to help you close the deal.*

* We do not discuss interest rates or your origination fee with the client

Financial Assessments and Counseling

- All parties on title are required to complete Counseling – Refer to the approved counseling companies listed in the proposal. Counseling is an approximately 60 minute long phone call. (Counseling Certificate is needed, signed and dated by borrower(s)

Before we can move on to Disclosures and 1009 there are a few other activities that need to take place, Financial Assessment Review and Counseling.

It’s best to perform the Financial Assessment before borrower spends time/money on counseling.

- All borrowers are subject to a Financial Assessment Review of credit, residual income, and payment history Real Estate Taxes and applicable HOA dues (lates on credit and property matter).

Remember, we’ll provide support and guidance to explain each step and how to proceed to accomplish each milestone.

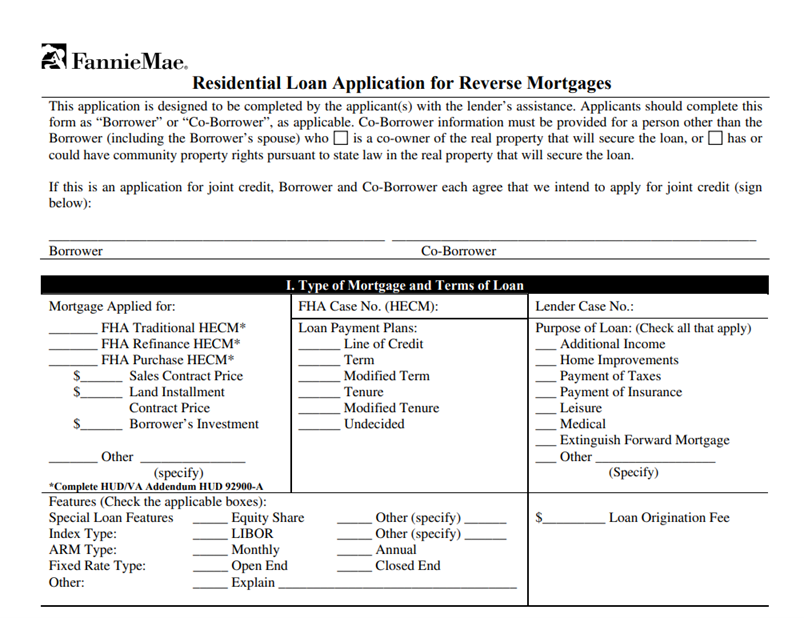

Application & Disclosures

Remember you have full access to run pricing and pull disclosures in Quantum Reverse LOS.

If you need help, we need these items to review financial assessment or to help with disclosures/application: Completed Request Form or 1009 and Credit report so we can help with disclosures.

If we are helping, we need the current loan number or a copy of the proposal that got them into counseling, along with an updated request form and credit report. We will send out the application/disclosures to you for review and approval.

Once you approve, we can send them out DocuSign. We will do our best to get them out ASAP.

Processing, underwriting and closing

Case Numbers

FHA HECM: Need a signed 1009 and counseling certificate by borrower(s) to request.

Email reverseez@reversemh.com to order an FHA case number.

Services Ordered

If FHA HECM make sure to have case number before ordering appraisal

- Order Title- Policy amount is based on Max Claim not loan amount for reverse mortgages.

- Order Appraisal from Approved AMC per program, need signed counseling certificate and disclosures/1009.

CA has a 7-day cooling off period from counseling, order services on the 8th day.

Submit to Underwriting

Quantum Reverse LOS: Make sure a program has been selected, Click on Milestone (upper left-hand corner) Origination. Review workflow, add processor, and click submit loan.

Email reverseez@reversemh.com the Quantum Reverse loan numbers and alert them of a new submission. Upload PDF into file or attach them to the email.

We will take new submissions without an appraisal and condition for it.

Attracting New Borrowers

We have extensive experience attracting reverse borrowers and we’ll teach you how, with a quick basic set of questions, to determine if the borrower is a likely candidate and if they qualify.

Below are some samples of sales materials we have available in our marketing portal. If you do not see what you are looking for or if you have a custom request we also offer access to our preferred marketing provider who can help you with print and web materials.

H4P to Consumer – Flyer

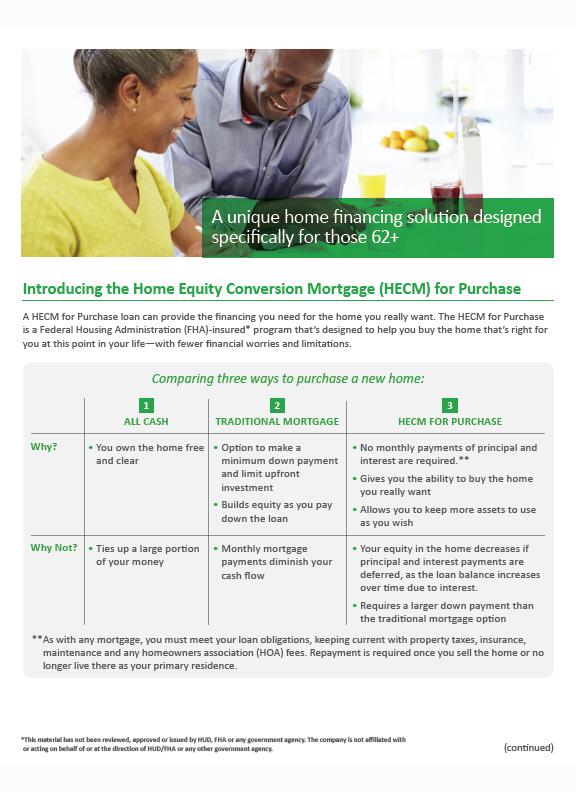

HECM to Consumer – Flyer

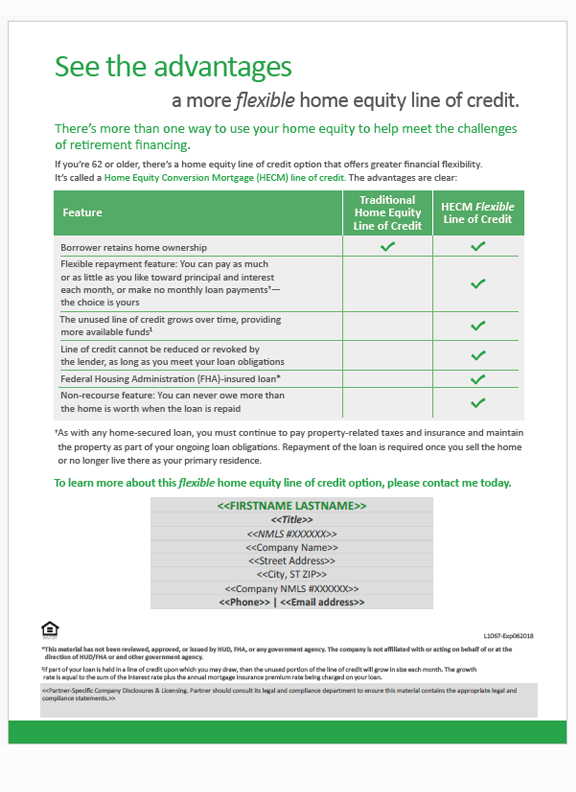

HECM to Consumer – Flyer

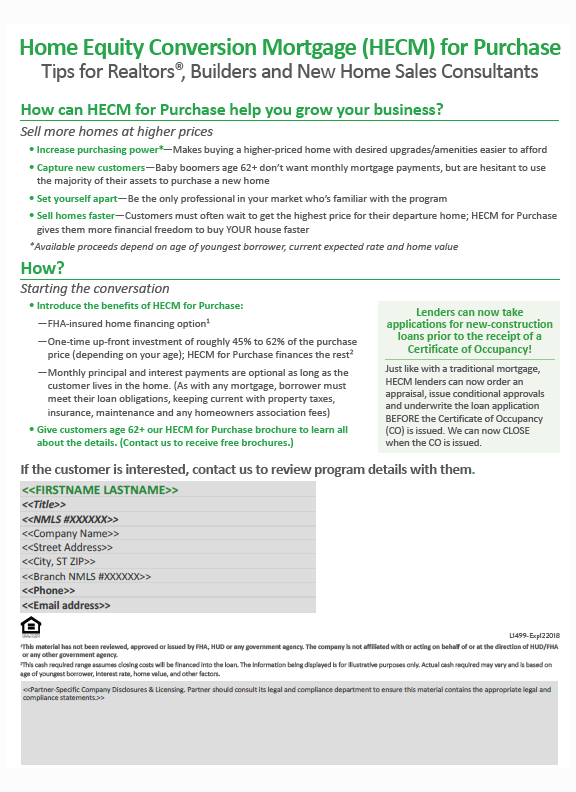

H4P to B2B – Flyer